As more and more ordinary citizens become concerned about fiat money’s instability (not to mention government overreach with the Snowden and NSA scandals), metals dealers are increasingly able to prey upon these fears to unload suboptimal gold products at steep prices. In particular, you may have heard rumors about government gold confiscation and why you should purchase gold collector coins to dodge such a program. So this week, we’re considering the history of gold confiscation and what it means for your metals investment strategy.

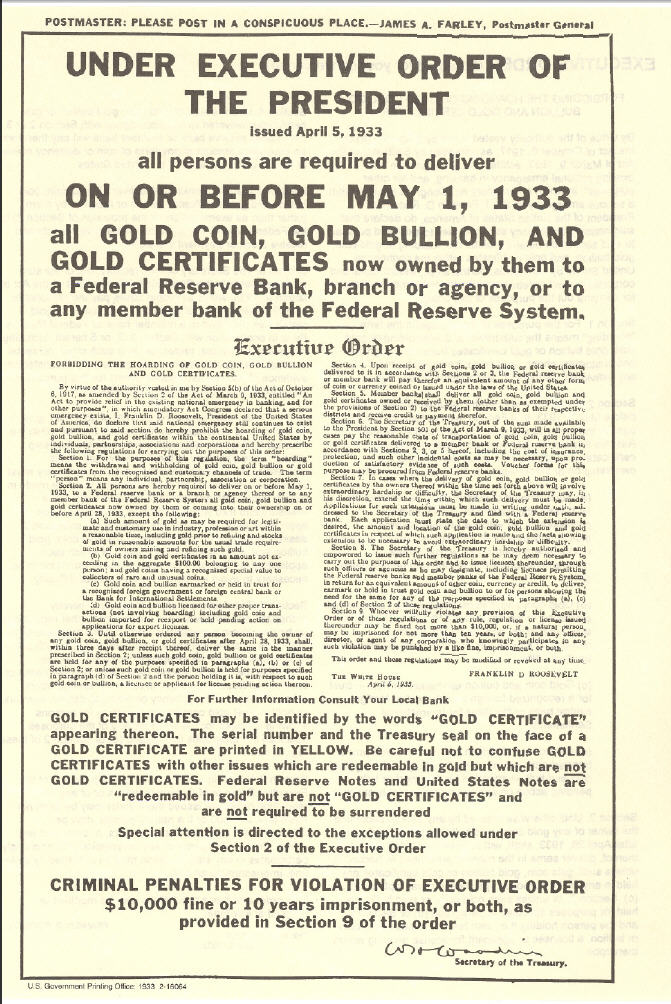

Gold confiscation fear-mongers typically cite the historically important confiscation undertaken in the United States by President Franklin D. Roosevelt in 1933. With Executive Order 6102, FDR forbid the hoarding of gold based on the logic that withholding that money from the economy prevented a recovery from the Great Depression. FDR ordered that holders of gold bars and bullion sell them to the government at about $20 per ounce, and then dramatically raised the price for gold to $35 per ounce shortly afterwards. Although there was no forcible confiscation, Americans largely voluntarily complied with the act out of a mix of fear and patriotism.

The act included an exception for “gold coins having a recognized special value to collectors of rare and unusual coins,” which is the precise clause gold dealers harp on when pushing their over-priced “collectibles.” However, it was unclear which coins in particular (and how many of them) would meet this criteria. Indeed, the ambiguity may have encouraged people to err on the side of caution, turning in more rather than less gold for fear of prosecution. In effect, the federal government greatly inflated the value of its own assets through the confiscation maneuver, making possible a huge wave of expenditures on war and Great Depression social programs.

That motivation doesn’t exist today. Because US dollars are no longer backed by gold, the government had to find another way to artificially seize our wealth. Enter the Federal Reserve’s quantitative easing, which doesn’t require physical confiscation of any sort of asset, let alone gold. A heightened unease about the Fed’s endless QE, combined with the recent crisis in Cyprus, where the government forcibly extracted value from individuals’ bank accounts, has made people nervous about confiscation once again. But notice that the Cypriot confiscation was achieved entirely on paper – no physical moving of money or gold required.

That doesn’t make the Cypriot savings haircut right or fair, of course. However, it reminds us that if your government wants to take money, it will do so in whatever way is easiest and most beneficial to itself. In FDR’s era, a physical gold confiscation happened to pack the most punch. But now that paper money isn’t backed by gold, the Fed is happy to inflate away your savings instead, sparing itself the hassle of a confiscatory buyback. So in today’s monetary landscape, purchasing physical gold has actually become a safer choice, as compared to holding all of your savings in bank-deposited fiat dollars.

Even setting all of that aside, shady gold dealers’ claim that you should buy collector’s coins as protection against confiscation still doesn’t hold up. First of all, there’s no reason to assume that the collector’s coins exception included in FDR’s confiscation would be included once again. No legal rules exist as to which gold materials are confiscateable. Moreover, a coin’s age or selling price is not necessarily a reliable indicator of its actual rareness or collectibility anyways.

Note that unscrupulous dealers love to jack up the prices of fairly common pre-1930 coins like $20 double eagles, $10 eagles, or $5 half eagles. Even when the coins are far from mint condition, these dealers may scare you into buying them for their alleged “unconfiscateability.” The reality of the matter is that many of these coins didn’t even survive FDR’s executive order, and were brought back to the US only recently after having been sold post-confiscation to Europe! There are many of them on the market, and they’re nothing special.

It’s unlikely that gold confiscation will occur again in the United States – the costs to the government now would outweigh the benefits. However, it’s becoming clear that the government will likely continue to “quantitatively ease” the economy while inflating away the value of your savings. Don’t misguidedly attempt to protect yourself against the speculative danger of confiscation with numismatics of doubtful quality. Instead, focus on protecting yourself against the known danger of loose monetary policy with the proven value of standardized gold bullion and bars from reputable dealers.