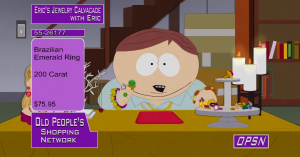

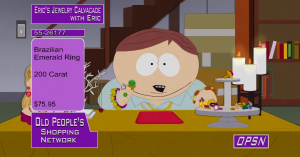

It’s no surprise that with the growing popularity of physical bullion buying, Trey Parker and Matt Stone take on the gold scamming culture we now live in. The creators of South Park have been tackling some timely issues (the TSA, Dolphin Killings, and next week the GOP Primary!) in a hilarious manner, so I wasn’t surprised one bit with the wit they added so gracefully into Episode 16 of this Season’s South Park:

Cash for gold stores and shopping networks have been around for decades, but with the new emergence of social networks, and the intergenerational use of the internet, the choices have now become more broad, allowing competition to weed out the scammers!

The bait and switch method still exists, and the example of home shopping networks in this episode is a great one, ie: selling at a “discounted” price claiming that the collector’s edition is worth way more. This same strategy is comparable to the numismatic sales from scammers who claim that the date or style of the coin, regardless of its metal content, will make it a worthy investment. Unless you can find the collector looking for that exact coin, it’s not.

Do you homework, and don’t end up like Stan’s grandpa. Read Peter Schiff’s Gold Scam report.

Happy buying,

Megan

http://www.southparkstudios.com/full-episodes/s16e02-cash-for-gold

So we recently began asking people to share their first gold/silver bullion buying experience. Little did we know how “off the radar” and hush-hush everyone would be. I’ve offered to not release any names but only the text sent our way. By sharing these types of stories with other buyers and curious investors we are working faster than the unethical bullion dealers can keep up. With peers near and far sharing their experiences, we’ll surely create an intelligent group of physical precious metal buyers who can pass the knowledge down.

So here’s one story from a reader about his transaction that happened over, none other than, our centripetal force of nature: Facebook.

“I knew my friend had some gold bars. I wanted one. So I sent him a facebook message asking if he was willing to sell me one. He was pissed that I sent a facebook message considering that he wanted his gold ownership to be ‘off the radar’. Regardless, he sold me a 1 ounce Credit Suisse ingot for Spot.

A few days later, I sent the ingot, plus $200 in twenty-dollar bills to my friend, a gold/silver dealer in Montana. He exchanged the CS bar for 10, 1/10th ounce Kruggerands.

I don’t really consider the Kruggerands and bag of junk silver an ‘investment’ but rather a hedge on ‘tail events’ like hyperinflation, currency controls, etc.”

One great point here is that the reader, who we’ll call Jane for now, wasn’t aware of the privacy measures her seller was trying to take. Not her fault, if you ask me. On another note, strategic plays with buying and selling gold and silver is a great way to immerse yourself in the market as well as connect with local dealers, who will most likely be the best place to sell your physical PM’s.

Submit your first silver or gold buying experience today in the comments section! We’d love to hear from you, and I’m sure our readers would too!

So here at Gold Scams we try to keep you abreast of the latest in scams happening around the world and perhaps even in your neighborhood. Our blog has been running for a few months now and we’ve generated quite the buzz on Facebook, where we already have over 4,000 Fans! So today we’d like to hear from you. What was your first, physical metal buying experience like? Did you run into any of the problems that are covered in the Peter Schiff Gold Scam Report while shopping for the right dealer? A salesperson pushing numismatics? Dealer ever ask you to meet in a Kmart parking lot? We want to know!

Today you get to share it with the world, anonymously if you so choose. Submit in the comments section of this article or on Facebook, and perhaps your story will be featured in an upcoming post here at Gold Scams. It could have been a unique experience, or one that could be seen as controversial. Either way, learning from each other’s experiences can help guide all precious metal investors down a more knowledgeable path.

All stories are welcome, so don’t hesitate to help out your fellow investors by sharing about that time you bought from your neighbor, the corner bullion shop in your hometown, or maybe from a company like Peter Schiff’s Euro Pacific Precious Metals.

We hope to hear from you!

-Megan

How’d they do it? By agreeing to pay up to $4.5 million to its former, disgruntled customers.

Gold Line was taken to California’s Superior Court after 19 consumer complaints were filed as a lawsuit in Santa Monica. Gold Line was accused of “bait and switching” customers, by luring them in with catchy bullion prices, then selling them on marked up numismatics. Sometimes the mark up was as much as 50%! If you read our previous article, you’ll know why that’s just down right criminal.

Gold Line didn’t get away with it scot free by just agreeing to a multimillion dollar settlement. They are now under surveillance from the state of California who will be recording phone calls, meeting with company executives, as well as “secret shopping” their business as they please to ensure lawful practices. Gold Line stated that these measures would “enhance its industry-leading disclosures to prospective precious metals buyers.”

As we’ve talked about here at Gold Scams before, numismatics can be risky when it comes to investing your wealth into precious metals. If bullion dealers are marking up the price over 7% on numismatics and selling you on their rarity and safety, find another dealer! Gold Line has been one of the greatest recent examples of everything you don’t want in a bullion dealer. I’m still baffled on how they plan to stay in business with a reputation like that. With all of the dealers across the country, continent, and world I’m sure investors can find a more ethical and trust-worthy place.