Now I usually do my dealing face to face with a local bullion shop, but just as Christmas shopping isn’t always done in a store anymore, neither are all precious metal purchases. Many friends and associates have mentioned the gold and silver buying options on eBay, Craigslist, and Amazon. Turns out it serves the same purpose as shopping for clothes online: it’s convenient. You don’t have to leave your chair. However, when factoring in the shipping, you are most almost always going to get a better deal buying direct from a dealer.

Another thing to note when shopping online for your bullion, aside from the convenience charge, is the fine print. The kind bullion buyer from www.targetrichenvironment.com shared a worthy scam you all should be aware of. On eBay beware of a silver bullion item with a vague description and a good price. That seller is hoping you skip the fine print and miss the fact that it is not the .999 you are looking for.

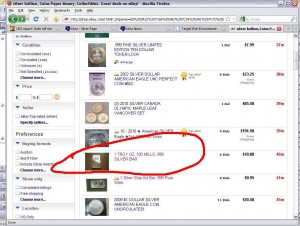

There are listings of supposed .999 silver accompanied by the words “100 Mills”. This isn’t pure silver. It is a copper bar or round plated in silver. The seller may tag the item as “1 Troy Oz. 100 Mills .999 Silver”.

I’m not dissing copper, but you don’t want to pay silver prices for it! An easy way to avoid from this not-so-sly trick is take note of bidding prices. If most people are underbidding or if there are unfavorable reviews on the seller, READ THE FINE PRINT. Actually, you should be reading the fine print anyway.

As the author provides this eBay advice, he also points out that while acquiring this “100 Mills” metal wouldn’t be the worst thing in the world, passing it off as the pure silver you think it is could get you into quite the batch of legal trouble.

So be careful this holiday season as you continue your shopping online. As a matter of fact, buying silver for that special someone is a great gift idea. Just play it smart and get educated now on buying precious metals the right way!

Happy buying,

Megan